Modern Banking for Modern Businesses

QRX Fintech’s Banking Suite helps businesses open accounts instantly, manage payouts, and secure funds — all through simple dashboards and powerful APIs.

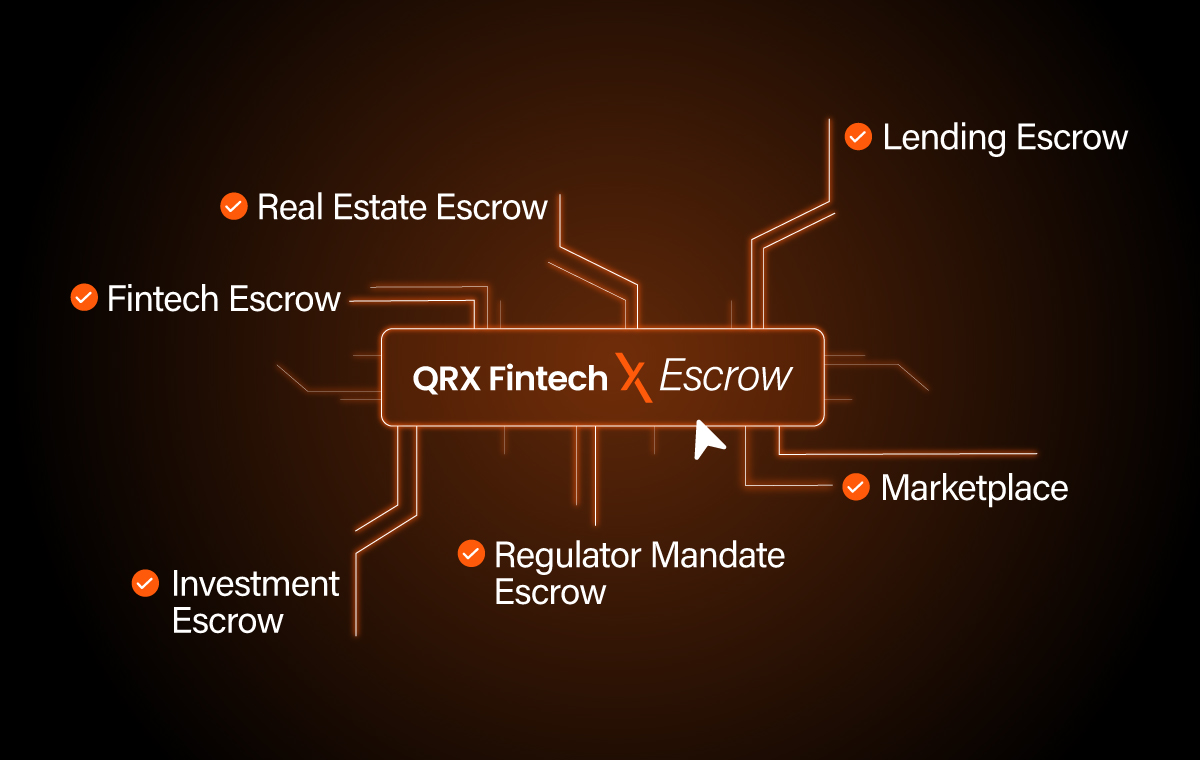

- Lending escrow

- Fintech escrow

- Real estate escrow

- Investment Escrow

- Regulator mandated escrow

- Marketplace

- Other Escrows

Our Banking Solutions

QRX Fintech offers secure, scalable, and API-driven banking solutions designed to simplify accounts, payouts, and fund management for businesses of all sizes.

Current Accounts

– Open digital current accounts instantly and operate 24/7.

Escrow Accounts

– Securely hold funds for marketplaces, lenders, and platforms.

Trustee Onboarding

Get 24/7 monitoring from experienced trustee for regulatory checks.

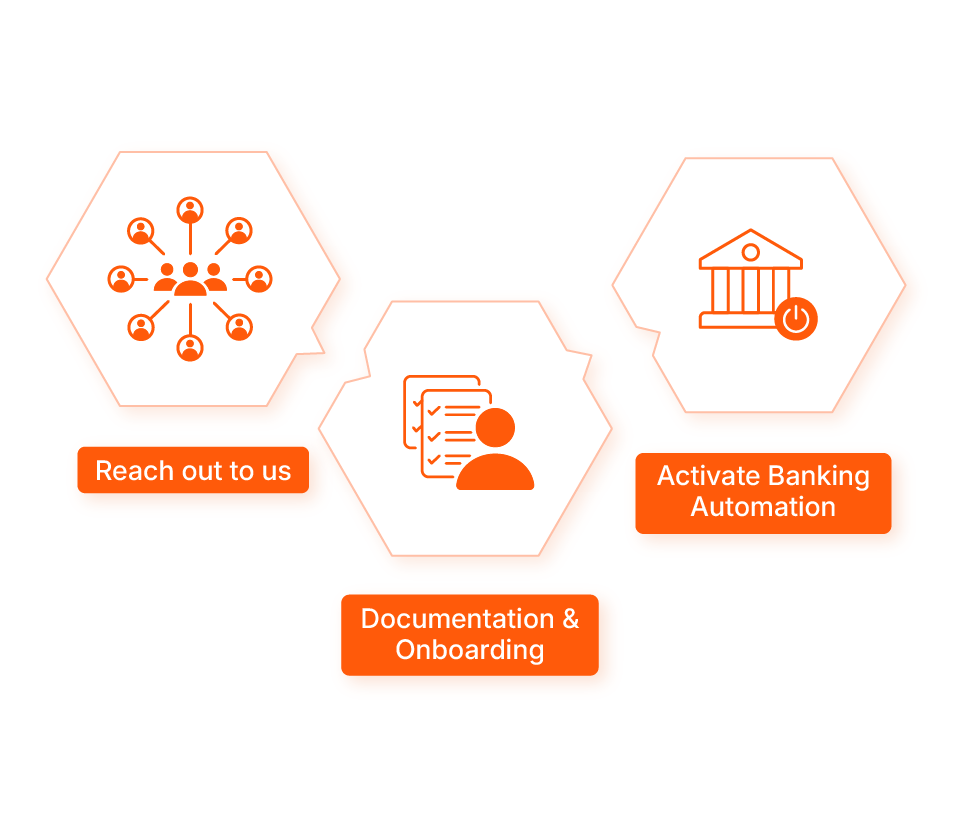

How It Works?

Reach Out to Us

– Get onboarded digitally in minutes.

Documentation & Onboarding

– Open current or escrow accounts with ease.

Activate Banking Auomation

– Make payouts via web, CSV, or APIs — anytime, anywhere.

Who needs Escrow services?

Marketplaces & Aggregators

– Manage vendor and seller payments.

NBFCs & Lenders

– Secure escrow accounts for loan disbursals.

Payroll & HR Platforms

– Automate salary payouts seamlessly.

Enterprises & MSMEs

– Simplify day-to-day transactions.

SaaS & Fintech Platforms

– Integrate banking directly into your workflows.

Why Choose QRX Fintech’s Banking?

Because your business deserves hassle-free banking that is fast, secure, and built to scale with your growth.

Easy Onboarding

– No long paperwork, go live easily.

01

Always-On Banking

– 24/7 transactions without downtime.

02

Multiple Payout Options

– UPI, IMPS, NEFT, RTGS supported.

03

Secure & Compliant

– Banking-grade security with regulatory alignment.

04

Designed for Scale

– From startups to enterprises, built for growth.

05

Frequently Asked Questions — Banking

If you’re new or looking for answers to your questions, this guide will help you learn more about our services and their features.

Q1. What is the difference between a current account and an escrow account?

A: A current account is your regular business bank account for daily transactions. An escrow account is a neutral, third-party held account used to securely hold funds (e.g. for marketplaces, lenders, real estate, or regulator-mandated flows) until predefined conditions are met.

Q3. Which payout methods does QRX Fintech support?

A: We support payouts via UPI, IMPS, NEFT, RTGS as well as bulk transfers via API or CSV.

Q5. Do I need to integrate APIs, or can I use a dashboard directly?

A: You can choose either. QRX Fintech offers both web dashboards and API integrations to manage payouts and banking workflows.

Q7. Can I switch from a current to escrow account (or vice versa)?

A: Yes, you can upgrade or change your account type depending on business needs. Contact support or your onboarding manager to assist with the switch.

Q9. Is there any minimum balance or monthly fee required for QRX Fintech banking?

A: There may be account-tier related fees or minimum balances depending on the plan you choose. These will be communicated during onboarding.

Q11. What happens if a payout fails (e.g. incorrect bank details)?

A: The failed transaction is flagged, and funds are reverted. You are notified of the reason (e.g. invalid IFSC) so you can correct and reprocess.

Q2. How long does it take to open a current or escrow account with QRX Fintech?

A: Account setup is fully digital. Once your KYC is approved, you can open your account (current or escrow) in days.

Q4. Are there limits on payouts or transactions?

A: We offer always-on banking with no downtime; transaction limits depend on account tiers or regulatory compliance. (Custom limits can be discussed in your onboarding.)

Q6. How does QRX Fintech ensure security and compliance of escrow funds?

A: Escrow accounts are protected via robust security protocols, encryption, and regulatory compliance checks. Funds are held in trust and only released when conditions are satisfied.

Q8. What businesses need escrow services?

A: Marketplaces, NBFCs/lenders, real estate platforms, payroll/HR platforms, and enterprises handling conditional fund flows can benefit from escrow accounts.

Q10. How do I track transactions and reconciliations?

A: All your transaction history, payout logs, and balances are visible in real time via the dashboard or API. You can filter, export, and reconcile easily.