Verify. Authenticate. Comply.

With QRX Fintech’s Verification Stack, businesses can instantly validate identities, accounts, and compliance data — ensuring trust, reducing fraud, and staying regulation-ready.

- Prevent fraud and financial risks

- Stay compliant with government & banking regulations

- Onboard customers, vendors, and partners faster

- Protect your business reputation with real-time checks

Our Verification APIs

QRX Fintech offers a comprehensive suite of real-time verification APIs to authenticate identities, accounts, and compliance data with speed and accuracy.

Bank Account Verification

– Validate beneficiary accounts before payouts.

PAN Verification

– Instantly authenticate PAN details for individuals & businesses.

Aadhaar Verification

– Secure KYC with UIDAI-compliant checks.

GST Verification

– Verify GSTIN details to ensure vendor compliance.

UPI Verification

– Confirm UPI IDs before initiating transactions.

AML & Sanctions Checks

– Screen entities against blacklists, PEP, and AML databases.

Cyber Risk Checks

– Identify fraudulent or compromised data in real time.

Court Case Checks

– Access litigation records to assess risk exposure.

IFSC Verification

– Instantly validate bank branch and IFSC details.

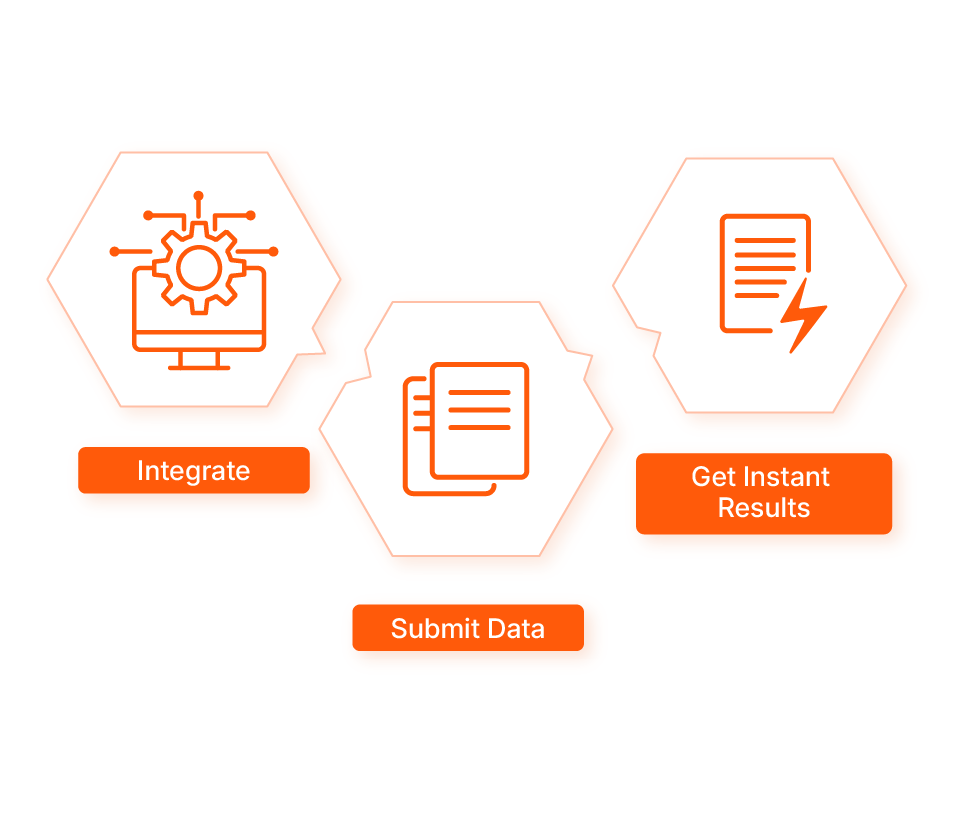

How It Works

Integrate APIs

– Plug Rigaro’s verification APIs into your systems.

Submit Data

– Customer/vendor details are sent securely.

Get Instant Results

– Verified, accurate, and reliable reports in seconds.

Who Can Use This?

Fintechs & NBFCs

– For onboarding, lending & compliance.

Marketplaces & Platforms

– Vendor, partner, and customer verification.

Enterprises & MSMEs

– Employee background and payment authentication.

SaaS & Payroll Firms

– Automate verification at scale.

Why Choose QRX Fintech’s Verification Stack?

Because your business deserves instant, accurate, and compliant verification that minimizes risk and builds trust.

Real-Time APIs

– Get results in seconds.

01

Compliance Ready

– Built for compliance with RBI, UIDAI & GSTN standards.

02

Scalable

– From startups to enterprises, built for every size.

03

Secure & Reliable

– Encrypted data handling with enterprise-grade security.

04

Frequently Asked Questions — Verification Stack

Q1. What types of verifications are included in QRX Fintech Verification Stack?

A: Our stack provides a broad set of verification services, including Bank Account, PAN, Aadhaar, GST, and UPI verification. We also perform AML checks, cyber risk assessments, court case searches, and IFSC validation.

Q3. What is required from my side to initiate verification?

A: You’ll need to supply accurate identifiers (e.g. PAN number, Aadhaar, bank account details, GSTIN). For certain checks (like AML or court cases) additional documentation or consent may be required, depending on regulatory requirements.

Q5. Are the verification services compliant with Indian regulations (KYC/AML laws)?

A: Absolutely. All our verification checks are compliant with Indian regulatory standards including KYC, KYB, AML rules, and related legal frameworks.

Q7. Can I verify both individuals and businesses?

A: Yes. Our verification stack supports both personal identity verification (PAN, Aadhaar, UPI) and business identity (GST verification, business bank account verification, etc.).

Q9. How are privacy and data security handled?

A: Your data is processed securely using encryption. Only authorized systems access sensitive data, and all checks respect relevant data privacy laws. Audit trails are maintained for compliance.

Q2. How fast are the verification checks completed?

A: Most verification checks are returned in real time or within a few minutes, depending on external data sources. Some checks (e.g. court case or AML sanctions lists) may take slightly longer if additional information is needed.

Q4. Can I use the verification APIs integrated into my systems?

A: Yes. QRX Fintech provides plug-and-play APIs so you can integrate the verification services directly into your app or dashboard. You can also run verifications using our web dashboard if you don’t want to integrate.

Q6. What happens if a verification fails?

A: If a check fails, we will provide a clear error or failure reason (for example, “invalid PAN details” or “mismatch in bank account records”) so you can correct and retry.

Q8. Is there a cost per verification, or is it subscription-based?

A: We offer flexible pricing — typically a pay-per-verification model or plans with volume discounts. Exact rates depend on the type of verification and volume. (Full pricing is shared during onboarding.)

Q10. Can I see the verification status and history anywhere?

A: Yes. QRX Fintech provides a dashboard where you can view status for all your verification requests, retry failed ones, and download reports. If using APIs, you also get webhooks/statutes for updates.