Collect Smarter. Grow Faster.

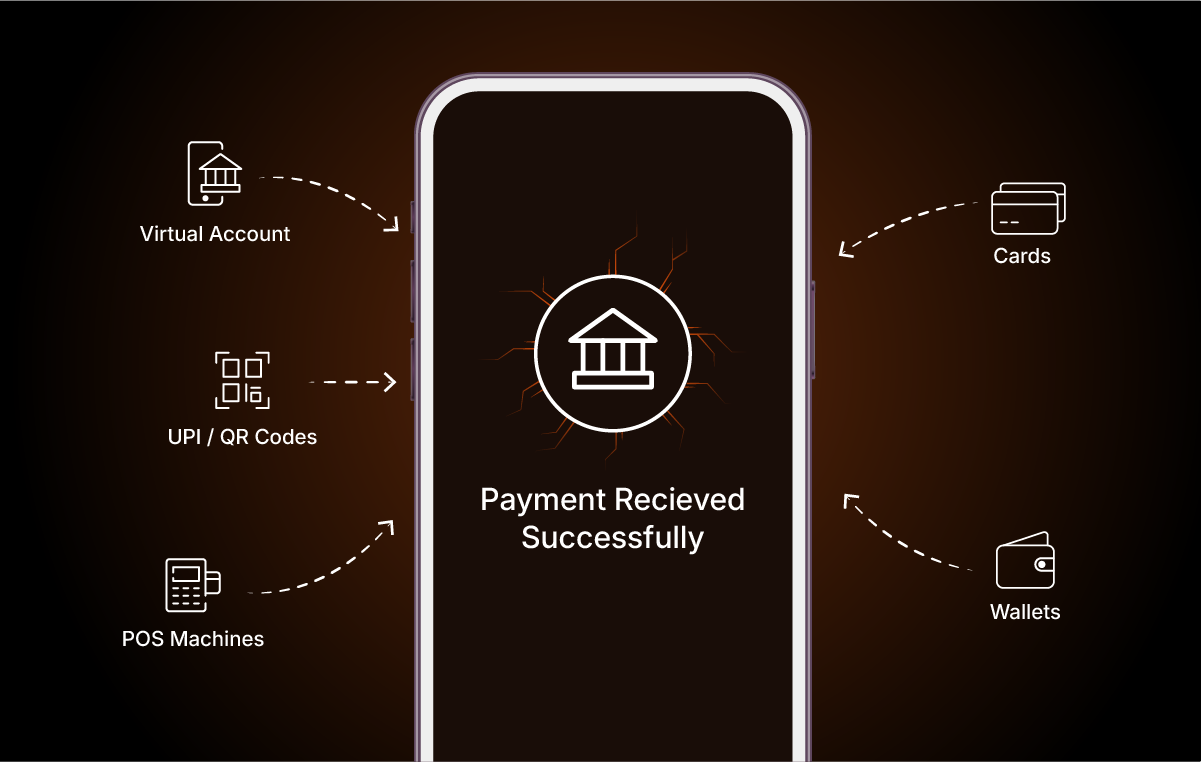

Rigaro’s Collection Suite helps businesses receive payments seamlessly through virtual accounts, UPI, cards, wallets, POS devices, and QR codes — all with instant settlements and transparent pricing.

- Simplify customer payments with multiple options

- Enable instant reconciliation with virtual accounts

- Reduce transaction costs with flat, transparent fees

- Empower franchises, branches, and vendors with dedicated QRs

- Improve cash flow with real-time settlements

Our Collection Solutions

Rigaro provides a complete suite of collection tools — from virtual accounts to UPI soundbox and payment gateway — designed to make receiving payments effortless and instant.

Virtual Accounts & UPI IDs

– Assign unique virtual bank accounts or UPI IDs for branches, vendors, and customers.

Payment Gateway

– Accept cards, netbanking, UPI, and wallets through a single integration.

UPI Soundbox

– Get instant voice confirmations for every UPI payment.

POS Machines

– Accept card payments easily at your stores.

Static & Dynamic QR Codes

– Collect payments from anywhere with ease.

Payment Links

– Collect payments from anywhere with ease.

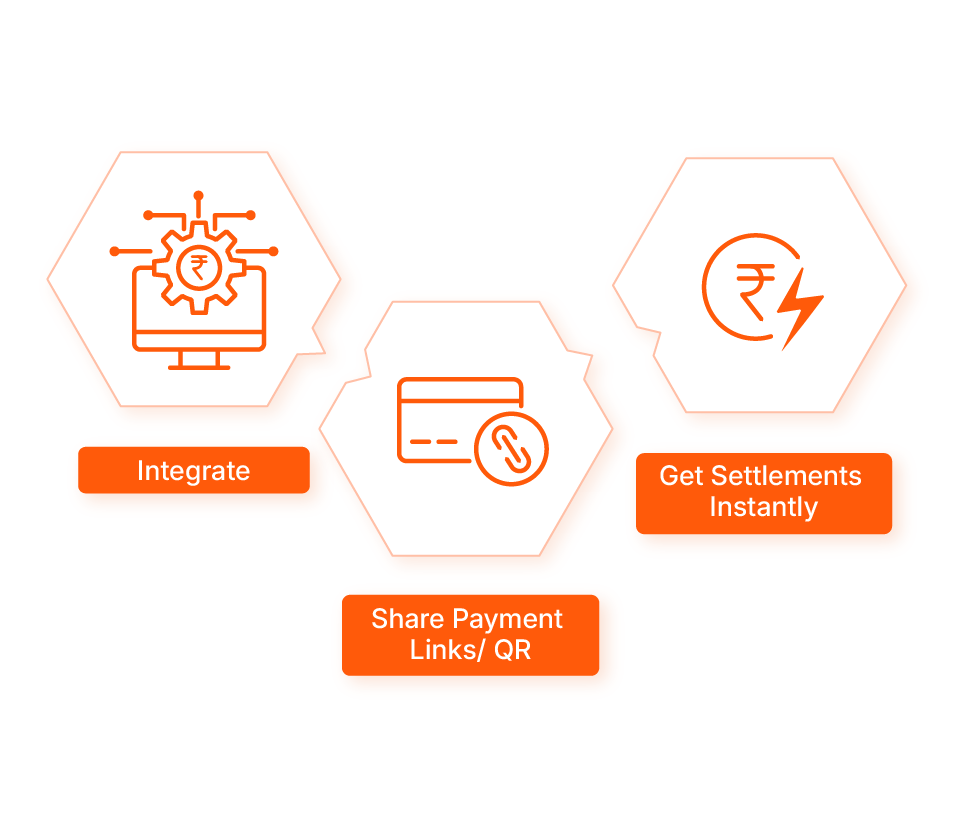

How It Works?

Integrate or Setup

– Choose virtual accounts, gateway, or offline devices.

Share Payment Links / QRs

– Customers pay via their preferred mode.

Get Settlements Instantly

– Funds are credited directly into your account.

Who Can Use This?

Retailers & Merchants

– Accept UPI, cards, and wallets at shops or outlets.

E-commerce & Marketplaces

– Streamline collections across sellers.

FMCG & F&B Chains

– Manage branch-wise payments with dedicated QRs.

NBFCs & Lenders

– Collect EMIs and loan repayments digitally.

Service Providers & SaaS Platforms

– Enable easy subscription or invoice collections.

Why Choose Rigaro’s Collections?

Because your business deserves fast, reliable, and cost-effective payment solutions that simplify collections and boost cash flow.

Instant Settlements

– Get paid in real time.

01

Flat Fees, No Hidden Costs

– Transparent pricing beats traditional MDR.

02

Multiple Options

– From UPI to cards, one platform for all.

03

Easy Reconciliation

– Track payments branch-wise, customer-wise, or vendor-wise.

04

Secure & Reliable

– Bank-grade infrastructure with 99.9% uptime.

05

Frequently Asked Questions — Collections

Q1. What collection methods does Rigaro support?

A: Rigaro supports multiple payment collection methods: virtual bank accounts / UPI IDs, payment gateway (cards, netbanking, wallets), UPI Soundbox, POS machines, and static or dynamic QR codes.

Q3. What is the settlement timeline for collected funds?

A: Funds collected through Rigaro collection services are settled instantly or within a short processing window depending on the payment method and banking hours.

Q5. Do I need to integrate APIs, or can I use a dashboard?

A: You can use either Rigaro’s web dashboard or API integration to manage your collection flows. Choose what works best for your business setup.

Q7. What happens in case of failed transactions or payment reversals?

A: Failed transactions are flagged immediately. You will receive notification with the reason (e.g. insufficient funds, invalid account). Refunds or reversals are handled automatically as per banking rules.

Q9. Can I have different QR codes or virtual accounts for different branches or franchises?

A: Yes, you can generate multiple virtual accounts or QR codes for different branches, regions, or product lines to manage collections separately.

Q11. How secure are the collection operations?

A: All transactions are encrypted, and we follow industry-standard security practices. Rigaro complies with regulatory and banking security norms to ensure safe payments.

Q2. How does virtual account / UPI ID collection help my business?

A: Virtual accounts and UPI IDs enable auto-reconciliation because every payer gets a unique identifier. This makes tracking payments across branches, franchises, or customers much simpler.

Q4. Are there transaction or daily/monthly limits on collections?

A: We aim to provide flexible transaction limits depending on account tier and regulatory compliance. Any limits (if applicable) will be shared during onboarding.

Q6. Can I collect payments both online and offline?

A: Yes. Rigaro supports online collection via card, UPI, netbanking, wallets, and offline collection via POS machines and static/dynamic QR codes.

Q8. How does Rigaro charge for collection services?

A: Rigaro offers transparent pricing with flat fees. There are no hidden costs. Fee structures will depend on the payment method and collection volume.

Q10. How does reconciliation work?

A: Rigaro provides tools to match payments automatically to invoices or orders using transaction metadata. You can also export reports or use APIs to sync with your accounting system.

Q12. Can I switch or upgrade my collection features later?

A: Absolutely. As your business grows, you can enable additional collection channels, switch to higher tiers, or request custom features.